Limit Orders

Limit Order is a pending Buy or Sell order that is executed when the price reaches the limit value specified when placing a position. A Buy Limit order is executed at the limit price or lower, while a Sell Limit, at the limit price or higher. It means that the opened position is filled at the indicated price or better.

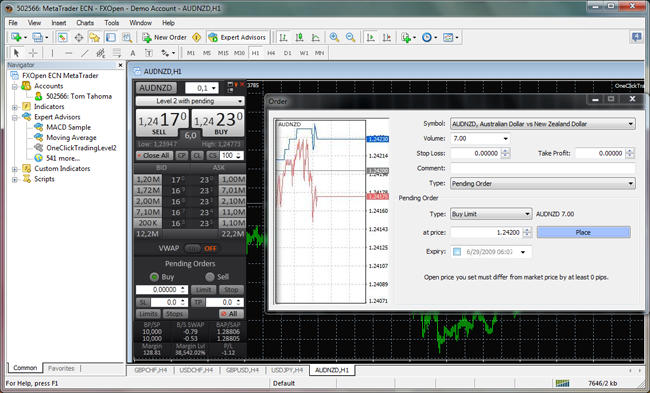

The placement and execution of Limit orders takes place when there are sufficient funds to meet the margin requirements at a particular moment of time, otherwise Limit orders are sent to the internal ECN system. There, Limit orders appear in the Market Depth (Level 2) and are displayed to other ECN participants in the interbank. They are sent for execution when there are sufficient funds to open a limit order and its price gets closer to the current market price values.

Limit Orders can also be placed within the DAB (the difference between the Best Bid and the Best Ask).

Partial execution is typical of Limit orders, especially in periods of high volatility or low liquidity. If there is no counter position within the required volume, the order is executed only partially however, the remaining part is not cancelled as in case with Market orders. It is displayed in the market until another counter position with a corresponding price and volume of a specified trading instrument appears. Then the initially placed position is filled completely.

Stop Loss and Take Profit parameters can be set for Limit Orders.