Triple SWAP Strategy

Traders, knowing the specifics of SWAP calculation, try to generate income by retaining an open position after the trading session closure. Although in most cases SWAP is negative i.e., a certain amount is deducted from a trader’s account, some currency pairs are characterised by positive SWAP parameters i.e., certain funds are credited to the trader’s account.

Some traders believe that the most substantial gain however can be achieved at the end of the trading session on Wednesday, when a triple Swap is charged, therefore they usually open large-volume positions within a short time frame in the hope of making a profit. This is actually the essence of their strategy. The positions are not held open for a long time but closed almost immediately after the positive SWAP occurs thus, speculators may buy currency 20-30 seconds before the SWAP is charged and close the position i.e., go short, 10-15 seconds after the rollover is credited to their account.

It must be clearly understood that during those 40-50 seconds from the placement of such position until its liquidation a “settlement” procedure is implemented in full. The settlement is provided by banks and LPs to enable traders to retain their positions open after the session is closed. It is generally associated with the rollover procedure when an execution of two opposite trades takes place with one liquidating the previously opened position and the other one reopening an identical position of the same volume but at a different price with the payment for overnight placement factored in.

The settlement is carried out for all contracts including short-time positions opened by triple-SWAP speculators. The haste with which they open trades is reasoned by the danger of adverse price movements, which may result in substantial losses which may be impossible to recover even by the use of a Triple SWAP. Positions are opened and liquidated within seconds, achievable through the application of advanced Triple SWAP Expert Advisors. Some Market-Makers are aware of such tactics and, therefore may influence the price by trying to control and protect the market from the use of such strategies.

The fluctuations of the currency pair during the process of settlement may affect the yield. If there has been no change to the quote or it has suddenly soared, a trader may come out of the trade with a gain or no proceeds at all however, they could get a positive SWAP credited to their account. In the case of adverse price movements a trader may incur losses that could be covered by positive SWAP payments. The gain will come in the form of the difference between the positive SWAP and the incurred losses coupled with the commission paid to the broker.

Let’s take an example, where the AUD interest rate is considerably higher than the USD interest rate which results in a disproportion of AUDUSD long and short positions with the volume of long positions exceeding the short positions on the market. When the trading session is over, the settlement procedure is launched. Long positions on AUDUSD are closed, which triggers more sales in Australian dollar. This process is naturally followed by decreases in the BID quotes and the widening of the difference between the Best ASK and the Best BID with little or no change to the ASK quotes. The BID price goes up after reopening of those trades i.e., after AUD repurchase, which eventually helps to normalise the different values.

In the ECN environment BID and ASK prices are displayed in the Depth of Market (Level2), which is constantly refilled by the data provided by the Liquidity Providers (LPs) as well as a broker’s own book of limit orders.

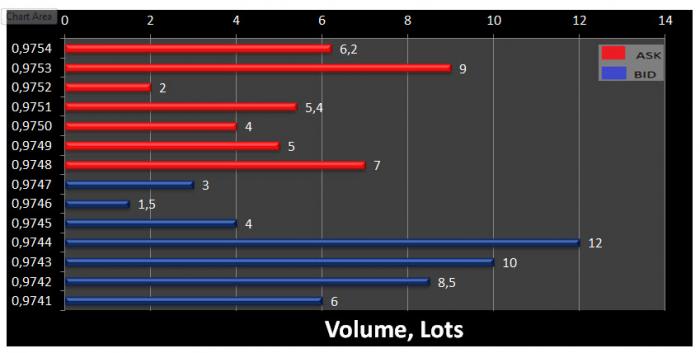

The Depth of Market may look as follows:

Pending Buy and Sell orders are grouped in line with the stated price with the BestBid and BestAsk displayed in the corresponding charts:

The settlement process (session closing) requires the liquidation of all positions followed by their further reopening with SWAP factored in. Given that a deal is closed by a deal on the opposite side, the Bank should sell the previously opened contracts to liquidate a Buy order.

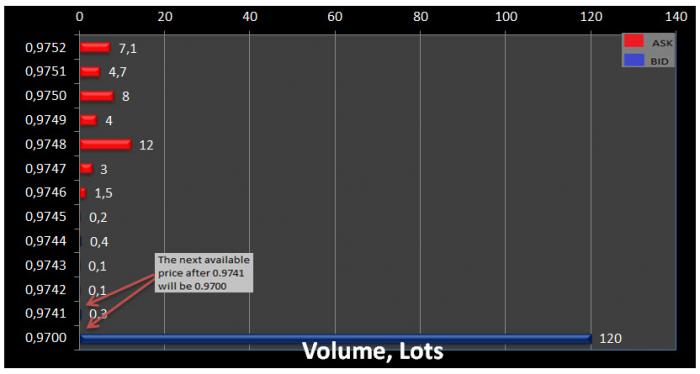

When the number of long positions exceeds the number of short ones, the pool of orders in the Market Depth looks as follows during the settlement:

A large volume of LPs’ Buy Limit orders is consolidating at a price level that differs greatly from the current one (the volume of 120 lots at a price of 0.9700). As for the Buy Limit orders of a broker’s clients, their share in total liquidity is much less (the price ranges from 0.9745 to 0.9741).

The BestBid and BestAsk prices are displayed on charts at a given moment in time. These prices stand for order execution prices however, the available volumes to buy or sell currencies at such prices may be negligibly small and if a large-volume order is placed, the execution price will be much worse than the displayed best prices. The current BestAsk price in the Market Depth is 0.9746, while the BestBid price is 0.9745. If there are no new orders placed by clients or LPs this short timeframe, the Sell Limit order of 1.5 lots’ volume at the price 0.9746 (Ask price) will be matched with Buy Limit orders of 1.1 lots’ total volume (0,2+0,4+0,1+0,1+0,3) at prices ranging from 0.9745 to 0.9741 (Bid prices). In this case 0.9700 will be the next available Bid price. Such a price gap may trigger a spike on the chart.

The Bid price will be maintained in the next few seconds after the reopening of AUDUSD long positions with SWAP factored in.

In case of a low Margin Level, a client’s positions could be liquidated in line with the Stop Out procedure. If a price Gap occurs, all deals will be automatically closed at the first available price after Gap, which may consequently lead to negative trading balances.

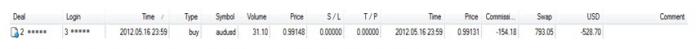

Example 1:

A client places a Buy order of 31.10 lots’ volume on AUDUSD at 23:59 server time. A few seconds later, after the settlement and SWAP procedures, they close their position. Despite the fact that the client comes out of the trade with the loss of - US$528.70 and pays commission of - US$154.18 to the broker for opening a position, they cover losses by SWAP charge equal to US$793.05 and nets a profit of US$110.17.

Due to an insufficient Margin Level and low liquidity in the market (e.g., large-volume trading), a trader may incur losses and squander most of their deposit.

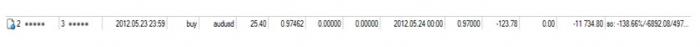

Example 2:

A client has US$5,026 in their account. They open a position with the volume of 25.40 lots with a Margin Level of US$4,951. Due to an abrupt price movement an order is automatically liquidated resulting in a Stop Out procedure. The client’s losses are US$11,734.80, while commissions to the broker totaled US$123.78.

The use of Triple SWAP Strategy requires thorough market analysis and is associated with high risks.