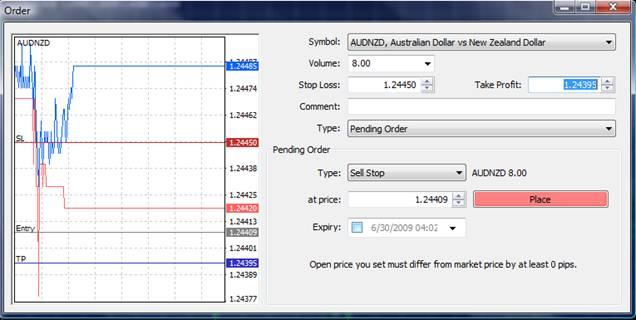

Stop Loss and Take Profit

Stop Loss (ST) and Take Profit (TP) are orders that are automatically attached to a pending order when placing a position. As for the Market order, ST and TP parameters can be added to the existing positions by the Modification mode. SL and TP exist only in conjunction with other orders. SL orders follow the Market order pattern of execution, while the execution of a TP is very similar to that of Limit orders.

The Stop Loss option is triggered to mitigate risks and minimise losses in ECN trading if the market starts moving against you. When the price reaches the initially specified level the position is automatically closed at the price currently available in the market therefore, the execution price is not always the best or desired one.

In case a SL order level falls within a Price gap, the position is filled at a quote given in the Price Flow when the Price Gap is over.

A SL order level, set close to the pending order opening price, may trigger the immediate closure of the position.

The Take Profit option is triggered to obtain higher profits. A position is automatically closed when a trading tool’s price reaches the TP level. In periods of low liquidity however, a TP may be only partially executed and consequently, the remainder of the position stays open until there is enough liquidity and the price reaches the TP level. If the price reverses and moves against the client, they may incur considerable losses.