Market Orders

Market order is a Buy or Sell order that is executed in the fastest way possible but not always at the best price you expect. The execution of the Market order triggers the following mechanism: the system finds the best price as counterparty for the Bid/Offer for a particular trading instrument. The system also analyzes the available volume of the counter positions to find the most suitable one.

Let us assume that the Bid price for GBP/JPY is 1.5876. The best available Ask price is 1.5878, therefore, if you buy GBP/JPY at the market provided and as a result of matching other parameters, it is sold to you at the offered Ask price of 1.5878.

There are cases however, when Market orders are not executed at the desired price. Due to market high volatility, your order may not be filled at the price you see when placing a position, but at the price the moment your order reaches the market and the gap between these two price values may vary greatly. It is however, not the worst scenario that might happen in case of a more rapid price movement.

Another reason for the difference in the price values is insufficient volume when processing an order. In this case an order can be executed at multiple prices i.e., the required volume is made up from the other positions (volumes) available in the Market Depth. In this case the order is filled at a volume weighted average price (VWAP).

Let us take a Sell order of 100 lots’ volume. The Depth of Market data displays the following available volumes:

|

Volume available in Market Depth |

Price Bid |

Volume to execute an order |

|

5 |

1.28389 |

100 |

|

25.1 |

1.28386 |

35 |

|

10 |

1.28388 |

95 |

|

57.2 |

1.28385 |

9.9 |

|

50 |

1.28387 |

85 |

There is no required volume that would provide a single block thus, we need to carry out a few transactions and calculate the average price. The whole procedure is given below:

- Each available volume is multiplied by the corresponding price:

5 x 1.28389 = 6.41945;

25.1 x 1.28386 = 32.224886;

etc…

- The previously obtained values are summarised to calculate the total price:

6.41945+32.224886+etc… = 128.386751

- The total price is divided by the total order volume to get the WAP:

128.386751 / 100 = 1.28386751 (rounded to 1.28386)

The whole procedure is automated, takes only a few moments and requires no additional steps from a trader.

Through lack of liquidity however, a partial order execution may occur. When the requested order to open a position exceeds the available volume in the Market Depth at a certain point in time only a part of the order volume can be executed while the other part is cancelled. The owner of the partially filled position gets a notification with further details.

It should also be noted that a Stop Loss and Take Profit cannot be set during the order placement in the “Market Execution” mode however, these parameters can be added to already opened positions with application of the Modification option.

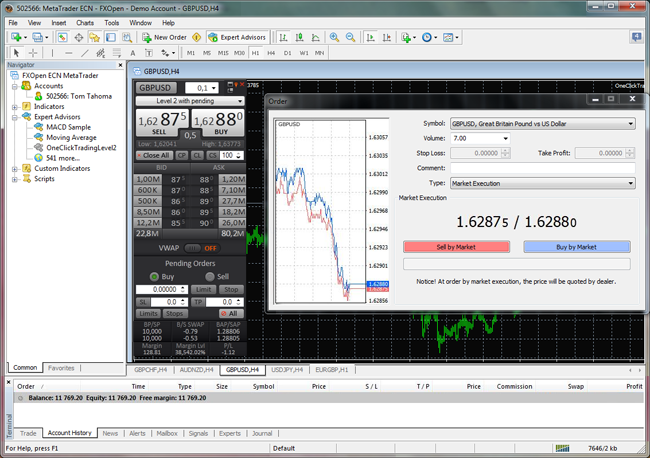

Example of Open Market Order