Carry Trade Strategy

Carry trade is an investment strategy governed by the following principles:

- the borrowing of a low interest rate currency;

- investing the proceeds into a high interest rate currency (currency conversion).

The gain is generated from the difference between the interest rates.

Followers of this strategy seek to trade in the interest positive direction i.e., they tend to buy currency they believe will best appreciate.

For example, GBP has a 5% interest rate, while USD has a 2% interest rate. When you go long on the GBP/USD, you are paid the difference between the interest rates of those two currencies by the broker thus, each day you may receive 3% credited to your account upon the condition that you have this position open.

Prior to making a deal, it is recommended that the trader should carry out an analysis of the current interest rates of the trading tools offered by banks and brokers. The most popular currency pairs used in carry trade strategy are AUD/JPY, NZD/JPY and GBP/CHF as they are distinguished by the highest interest rate indicators. Researching the economy of the currency you choose to trade is recommended.

One of the cornerstones of the Carry Trade Strategy is the potential for accumulating earnings i.e., a trader opens a position and goes long in the interest positive direction. After the settlement procedure is over, a positive SWAP is credited to their account. A trader may also prolong their position and retain it open each day, including Wednesday night, when a Triple SWAP is charged. To lower the risk of losses caused by sharp price movements, the trader enters a hedge by opening the opposite position on the same currency pair but in a SWAP-free account. As a result, a trader’s yield in a SWAP free account totals zero, while real profits are made by compounding the positive SWAPs credited to the first account on a daily basis. Therefore a carry trade is a long-term strategy and it is more suitable for investors rather than day traders. Investors (major banks and hedge funds) may hold their positions for months, generating massive returns over the longer term.

Please refer to the example below:

To hedge a carry trade, there should be two trading accounts with identical trading terms – standard and SWAP-free. Please, note that a SWAP-free account is provided to Islamic customers who are not allowed to receive swaps owing to their religious beliefs.

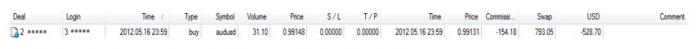

This particular example dates back to 15th October, 2012. The trader goes long on AUDUSD in their account 46****in the hope to profit on the positive SWAP since the AUD lending rate is much higher than the USD borrowing rate (pic.1)

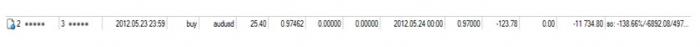

The client then goes short on AUDUSD in their SWAP-free account 44**** due to the high risk of adverse price movements on AUDUSD and as a consequence, the potential for losses incurred after position liquidation (pic.2).

Upon the condition that the client’s account 44**** is SWAP-free, a broker does not charge SWAP for keeping the position open after the first settlement procedure otherwise, the negative SWAP on the SELL AUDUSD would have exceeded the positive SWAP on the BUY AUDUSD.

Thus the client has hedged the position and has minimised the risk of adverse price movements on AUDUSD i.e., the client may keep the position open as long as it remains consistent with their strategy or until the interest rates ratio, provided by the US and Australia Central banks, remains reasonable.

|

Account activity |

Account 44**** |

Account 46**** |

|

Profit & Loss |

-207.40 |

202.60 |

|

Commission |

-0.51 |

-0.51 |

|

SWAP |

0.00 |

46.64 |

|

Total gain by accounts |

-207.40 |

248.73 |

|

Total gain by strategy |

|

40.82 |

The profit on account 46**** almost makes up for the losses of the SWAP-free account 44**** i.e., the earnings come from the positive SWAP credited to account 46****.

The Carry trade strategy seeks to provide an income upon the condition that an exchange rate of a particular currency remains stable or is just about to rise as a direct result of the Central banks’ monetary policy. Anything that may provoke confusion or insecurity e.g., natural disasters or other geopolitical or macroeconomic factors, may threaten stability and lead to the disruption of carry trades.

This investment method obliges a trader to control the risks associated with adverse price movements on a particular financial instrument.

To mitigate losses you are advised to make note of the following:

- Deposit only half of your available funds in your trading account. The balance should be kept in a bank and thus readily activated if Margin Call occurs;

- Avoid opening large-volume positions;

- Choose a moderate leverage ratio;

- Diversify your currency portfolio;

- Avoid exotic trading tools. Such currencies may bring good profit but may be subject to extreme volatility which may result in the Margin Call option being triggered;

- Enter the market gradually.

Despite that in most cases this investing method implies hedging, its application requires thorough analysis of the market situation and is still associated with risk.

It must be noted that many brokers consider this strategy irregular and restrict its usage. In order to avoid any dispute, it is recommended that trading terms are clarified before implementation.